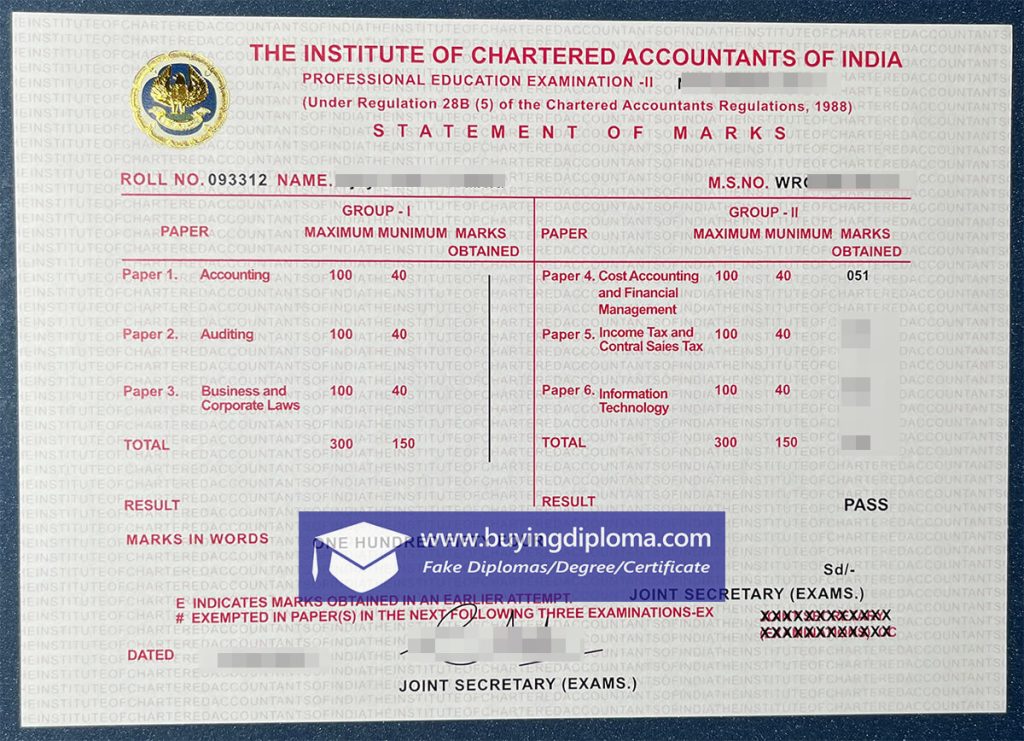

Buy a fake ICAI certificate with transcript

Buy a fake ICAI certificate with transcript. Order fake Institute of Chartered Accountants of India certificate online. How can i get a fake Institute of Chartered Accountants of India diploma. Make fake ICAI certificate for job. Buy real certificate. Make fake Indian certificate online. Puchase fake certificate transcript in India. The Institute of Chartered Accountants of India (ICAI) is a statutory body established by an Act of Parliament. The Chartered Accountants Act, 1949 (Act XXX of 1949) to regulate the profession of Chartered Accountants in the country. The institute functions under the executive control of the Ministry of Corporate Affairs, Government of India ICAI is the second largest professional body for chartered accountants in the world and has a strong tradition of serving the Indian economy for greater value.

How can i buy a fake ICAI certificate for job.

How to find fake certificate maker near me. Get a fake degree, find best fake diploma site. Purchase diploma online, fake degrees that look real. BEST fake transcript. The functions of ICAI are governed by the Board under the provisions of the Chartered Accountants Act, 1949 and the Chartered Accountants Regulations, 1988. Central Government on behalf of Comptroller and Auditor General of India, Securities and Exchange Board of India, Ministry of Corporate Affairs, Ministry of Finance and other stakeholders.

For a time, ICAI became the premier accounting body not only locally but globally, maintaining the highest standards in technical and ethical fields and maintaining rigorous standards of auditing and education. Since 1949, the profession has grown in terms of membership and student body

Main Responsibilities:

- Standardization of the accounting profession

- Teaching and testing for legal accounting courses

- Continuing professional education

- Open qualifying courses

- Drafting of accounting standards

- Description of Standard Audit Procedures

- Setting ethical standards

- Quality control through peer review

- Ensure performance standards for members

- Exercise of disciplinary authority

- Financial reporting review

- Policy issues for public investment